Here are facts you should know and understand about Motor vehicle Advance Income tax. Find out how much you are supposed to pay, and how to generate the assessment to pay the tax.

John bought a Fuso truck from Hassan. According to the agreement, both parties had agreed that on the date of the balance payment, Hassan was supposed to hand to John the original logbook of the truck he had sold, in addition to initiating the transfer application so that John gets a new logbook of the said truck in his own names.

On the payment day, I personally helped the two parties write the final agreement, after which Hassan initiated the vehicle transfer on the URA portal after logging into his account, printed the forms, attached his ID photocopy, and signed and handed the original logbook to John. John added his own ID, made transfer and payment fees to the bank, attached the payment receipt on the form, and rushed to Licensing section to submit it.

Guess what, on submitting, the attendant asked John whether they had made an Advance payment for the truck. John responded that he didn’t know about that since he had just bought the truck. When he contacted the seller, he was told that he had to pay that amount as per the current Uganda revenue authority income Tax for those persons in the TRANSPORT SECTOR.

What lesson do we learn here?

While the different tax laws do exist, many people seem not to know much about them. If what happened to John hasn’t happened to you yet, take yourself to be lucky for having landed here since this article will help you get to know, learn and understand the different URA advance taxes for passenger service and goods/freight vehicles when transferring ownership.

How To Pay Advance Income Tax

- Visit “URA Website”

- Click “Register a Payment”

- Select “Tax Type (For IT,VAT,Excise,With holding,Gaming Tax etc)”

- Select Income Tax “Advance tax for motor vehicle” under Tax Head

- Fill in all required details including TIN, vehicle number, etc

- Follow prompts and an assessment will be generated.

- Pay the PRN to your bank of choice and you will be done.

How the advance tax is collected?

A person seeking to transfer their commercial vehicle or acquire an operating license from the Transport Licensing Board (TLB) or any other regulating body say KCCA has to pay the income tax in advance first before such service is provided to him or her. Payment of such tax is made in the bank and a Payment Advice Slip will be presented as evidence for the tax paid for one to qualify for an operating license. This includes both locally registered and foreign registered vehicles conducting business in Uganda.

How much is Advance Income Tax in Uganda?

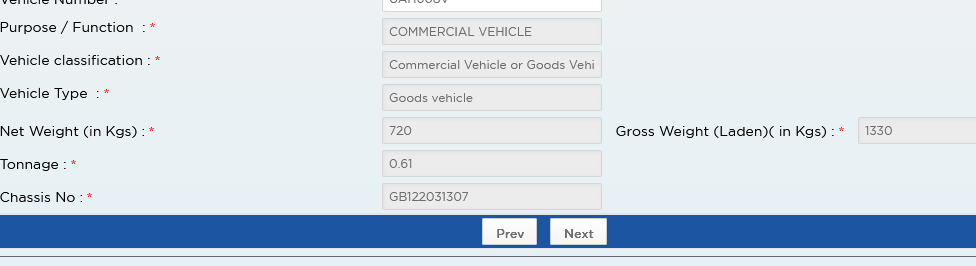

Commercial vehicles: If a Gross weight of a lorry as per the logbook reading is 7 tonnes, the advance income tax is calculated as follows: Tonnage X amount paid per ton eg 7 tonnes X 50,000 = 350,000 shillings per year.

Passenger vehicles: If an Omnibus carries 14 passengers, the advance income tax is calculated as follows. Number of seats X amount paid per seat eg 14 seats X 20,000 = 280,000 shillings per year. If a bus carries 67 passengers, the advance income tax is calculated as follows. Number of seats X amount paid per seat eg 67 X 20,000 =1,340,000 shillings per year.

Goods vehicles: If a trailer/s is licensed to carry 40 tonnes, the advance income tax is calculated as follows. Tonnage X amount paid as tax eg 40 X 50,000 =2,000,000 shillings per year.

Motorcycle (Boda Boda): A bodaboda is licensed to carry one person and therefore pays 20,000 shillings as income tax every year.

NOTE: Paying this tax is solely the responsibility of the owner of the vehicle.

What is expected of the people in this sector?

• Voluntarily come up and register for taxes (obtain Taxpayer Identification Numbers)

• Approach any URA office for help when is stuck

• Keep records of your transactions

Environmental levy on used vehicles

• Used imported cars that were manufactured 5-10 years ago pay 35% of the CIF value as an Environmental levy

• Used imported cars that were manufactured 10 years and above pay 50% of the CIF value as an Environmental levy

In my view, it means both parties involved in this kind of transaction need to reach a conclusion on who exactly has to be the costs involved since failure to do so means the inability to have the motor vehicle transferred to the new owner not until the advance tax has been cleared. The amount of money you are supposed to pay as Advance tax is determined by the kind of vehicle involved in the transaction as seen above.

Now that you have seen what is required, and the much involved, it is very important to always reach an agreement otherwise, you might end up like what happened to John where efforts to have Hassan, the seller share with him the costs involved seem to be fruitless and thereby being the responsibility of John to clear 100% fees.

Disclaimer: This guide is for informational purposes only, and valid at the post date. It is subject to change by the tax administration and is in no way a substitute for official guidance. Refer here for more info and an updated version in case of any changes.

Discover more from Thekonsulthub.com

Subscribe to get the latest posts sent to your email.