You can get a UBA Debit MasterCard or Prepaid Debit Card from any of the nearest bank branches across the country once you open up an account and request the card. Since the card is linked to your bank account, making any type of transaction becomes much easier since you are able to spend what is credited onto your account.

Whether you have a prepaid debit VISA or MasterCard, you are able to spend what you credit on the linked account using your card and the process involves nothing like Credit checks. Whether you have bad credit, are a traveler, or are a teenager, UBA’s Visa and MasterCard are the best options for you.

About UBA Bank

Also known as the United Bank of Africa, it is one of the largest financial institutions and service providers in Sub-Saharan Africa with its origin being in Nigeria. According to Wikipedia, the United Bank of Africa offers financial-related services to more than 7 million customers across their 750 branches.

UBA Bank branches

The bank has branches in Zambia, Uganda, Tanzania, Sierra Leone, Senegal, Mozambique, Mali, Liberia, Kenya, Guinea, Ghana, Gabon, Côte d’Ivoire, Congo Kinshasa, Congo Brazzaville, Chad, Cameroon S.A, Burkina Faso, Benin, and in France, Capital Europe, United Kingdom, and New York as a representative office.

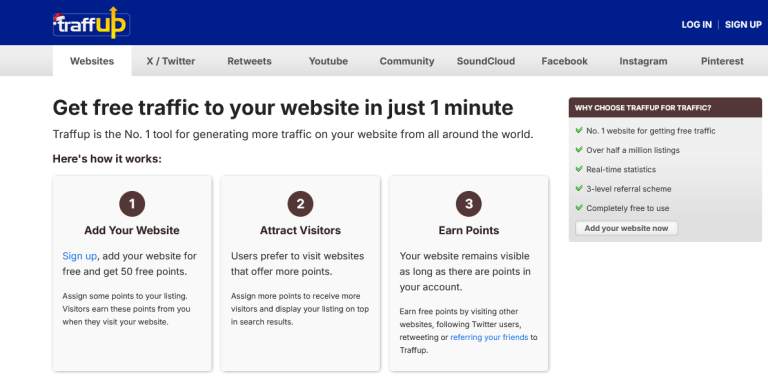

United Bank of Africa offerS Prepaid Visa debit and MasterCards which can be used to shop online, to pay, to transfer funds on other cards, and many other features at the best fees, similar to what other debit cards work for example verifying PayPal account.

UBA Bank Card services and fees

|

Service |

Fees |

| Getting a new card | UGX 10,000 |

| Replacing a lost, damaged or expired card | UGX 15,000 |

| Monthly service charge | Free |

| Cash withdrawal on ATMs at any UBA branch | UGX 700 |

| Cash withdrawal on ATMs abroad* | UGX 7,000, + 2% |

| Purchases made on POS and on local websites in Nigeria | Free |

| Purchases made on POS abroad and on foreign websites* | 3% *Applicable fees for international ATM, POS and WEB transactions are subject to market changes |

Note: The above charges are quoted into Uganda shillings.

Requirements For Opening A UBA Bank Account

- A Bank statement from your current banker.

- Passport Photographs which are current

- The initial deposit fees (activation fees).

- Any other documents required.

Note: Some of the above requirements may not apply depending on where you are located.

How to get UBA Instant VISA / MasterCard

- Open up a bank account by visiting the nearest branch and submitting in the above requirements.

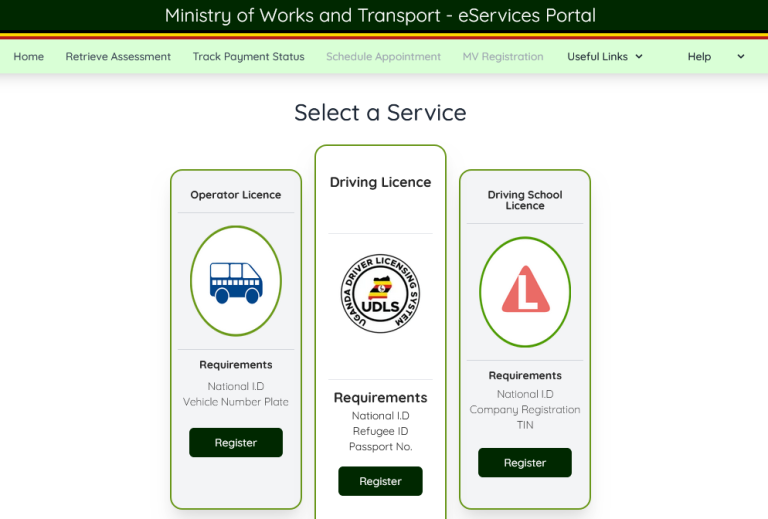

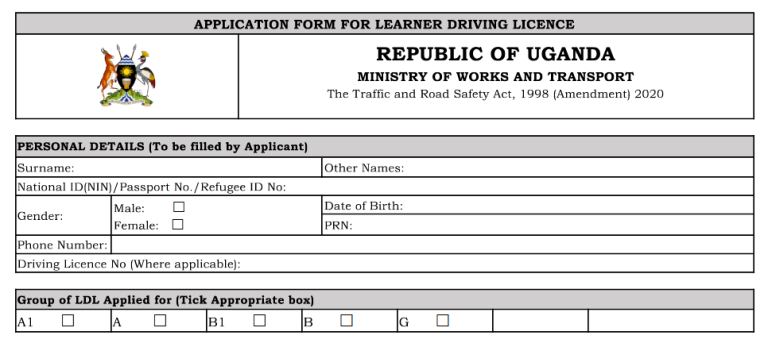

- You will be given forms to fill and attach all relevant documents including a recognized form of identification for example a Passport, Drivers License, National Identity Card and others like your current passport sized photos

- Fill in the forms as required and submit them at the same point for verification.

- Upon approval, you will be given an account number for your prepaid card of which you will need to deposit a fee required whilst your card is being processed.

- Your card will be handed to you instantly or as told by the bank staff.

You are done. The next step will be activating your card for online/pos services once it has been issued to you. This you will do by following the simple instructions below.

Activating your card

- Visit myubaafricard.com

- Enter given Username / customer ID and passcode

- Complete the online process.

That is all. You are done. Your UBA bank prepaid instant VISA or MasterCard will be successfully activated, and you will be ready to start transacting, for example, you will be able to link your card to a PayPal account and buy an amazon gift card. Also, logging into the portal will allow you to check all of your transactions. However, you should stay watch of the ongoing scams where many share having fallen victims to Senegal’s fraud.

Discover more from Thekonsulthub.com

Subscribe to get the latest posts sent to your email.