A URA taxpayer account is mandatory for all eligible individuals, organisations and companies in Uganda. Having this allows one to perform the different tasks which require login when it comes to government tax related issues, for example registering a payment for driving permit renew.

Unlike in the past when things were done the manual way without such a need, currently things changed after the establishment of the URA eTax feature where by all tax payers are required by laws to have a new TIN number, whose credentials are used to create the portal account.

A Tax payer account serves functions like motor vehicle registration, validation, transfer, registering taxable payments, filing returns and very many others as per ones requirements and or obligations for example, stamp duty taxes .

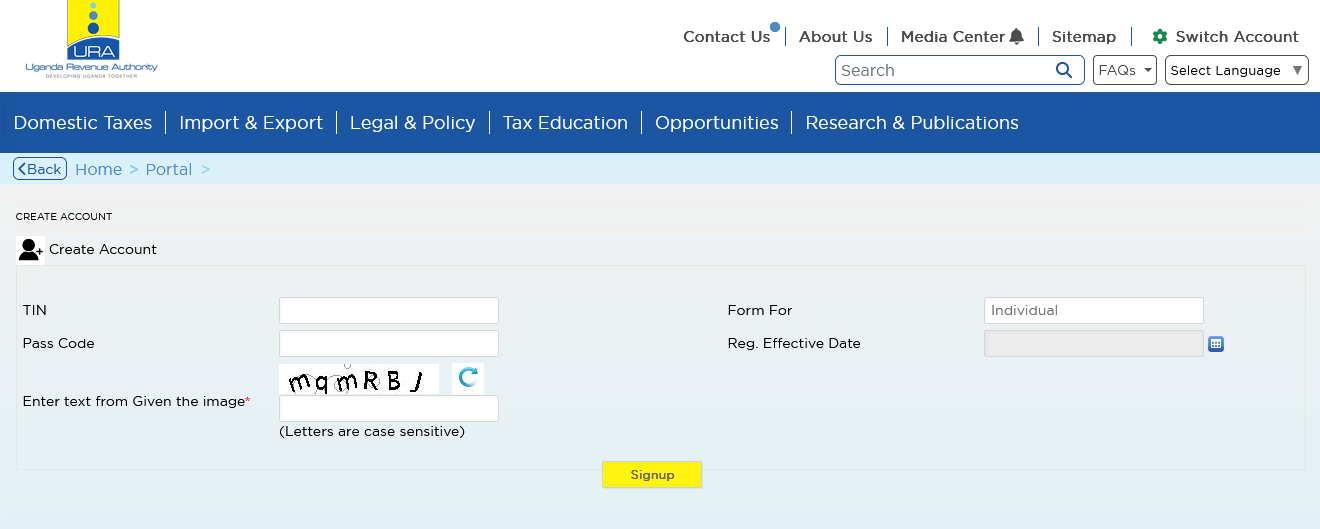

Step by step procedures for creating URA taxpayer account.

- Visit the URA website

- Enter “Create an Account” in the search bar

- Click on “Create Portal Account”

- Enter your TIN Number

- Select Form i.e,TIN Individual or TIN Non-Individual

- Enter the registration effective date

- Enter the pass code

- Click submit.

Points to note

- The first thing you should have before all is an active TIN number and which is gotten free of charge at any URA office after applying for it.

- The effective date is located on your TIN number certificate and too in the email message you got confirming your TIN registration.

- The passcode is also located in the email message you got confirming your registration. But you can request one if you don’t have yours yet still on the same page using the request pass code link and click on submit.

Once your submitted information is correct, you will receive an email message on your TIN registered email address confirming receipt of your Account application. Upon review by the URA staff, you will get another email within a few hours with details like your login ID and your Password which you will be using from time to time to log in to your URA taxpayer account.

Discover more from Thekonsulthub.com

Subscribe to get the latest posts sent to your email.