With many car financing companies in Uganda ready to help out, anyone can make that dream of owning and driving his own car possible. This is due to the fact that one only is required to provide a few requirements in order to obtain a dream car, which excludes the need for collateral or security, which used to be mandatory for traditional lenders like banks.

Whether you are planning to get used cars on loan in Uganda or looking for that new car financing company without security, this guide will help you learn how, where to go for such, and also what you can do with your loaned motor vehicle in order to be in a position of repaying the loan easily.

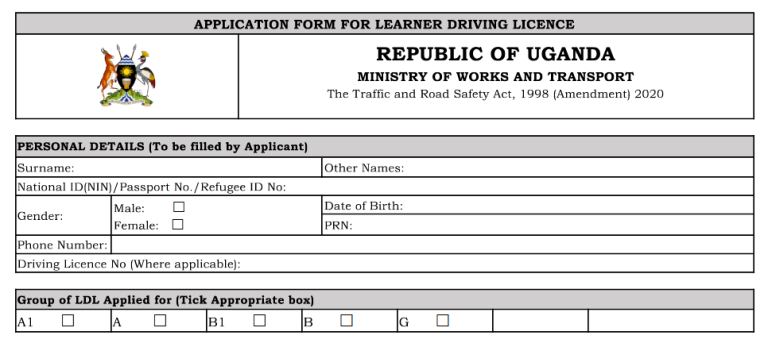

There are many loan companies in Uganda who are waiting for you to visit them in order to get that dream car. You can secure Probox car loans, etc anytime without the need for security. In reality, a national identity card, a valid driving license, and proof that you will be in a position to pay the loan are mandatory requirements.

When Mukose got into a misunderstanding with his brother with whom they had teamed and bought a car, he spent close to 3 months without driving. It was at this time that his longtime friend introduced him to Mogo car loans in Kampala where he managed to get a Toyota Raum at a good offer, and with a flexible loan repayment period.

Without having anything like security or collateral, his friend acted as a Guarantor and he was able to drive again after paying 20% of the total motor vehicle value. Do you know what this meant to him? He was very happy and is still managing to get back on the road.

If you are like Mukose, follow the below steps to get a quick car loan without security in Uganda.

How to get quick car loans in Uganda

- Have your national ID card ready

- Have proof that you will be able to pay

- Have a Guarantor ready

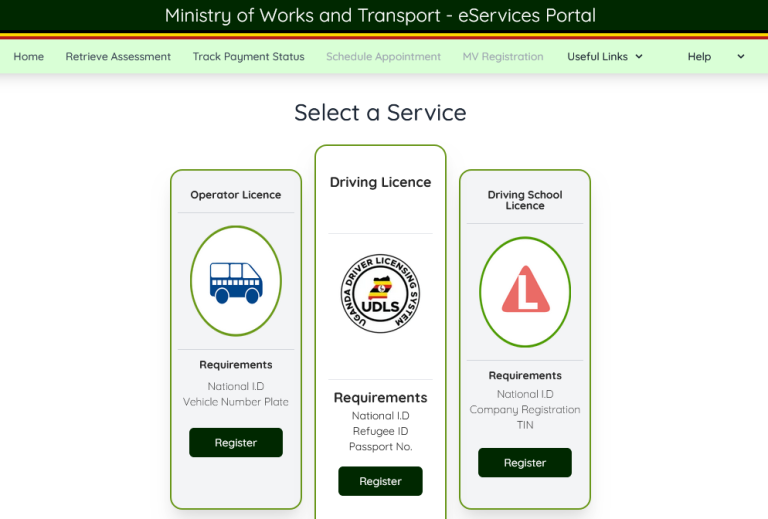

- Visit any car financing company

- Fill out and sign the application form

- Pay the initial deposit depending on the percentage agreed

- Pick your car at the agreed date or immediately

If you didn’t know, getting a quick car loan in Uganda is very possible if you have any of the supported identification ways like the national ID card. Whether you decide to go for the popular SBT Uganda car loan, or even choose to partner with UBER for their car loans, you will be required to have an identification.

Where to buy a car in installments in Uganda

- Mogo car loans

- Centenary Bank

- Equity Bank

- Standard Chartered

- Ramzan Motors Limited

- Checki.co.ug

- Beforward.jp

- Auto-rec.jp

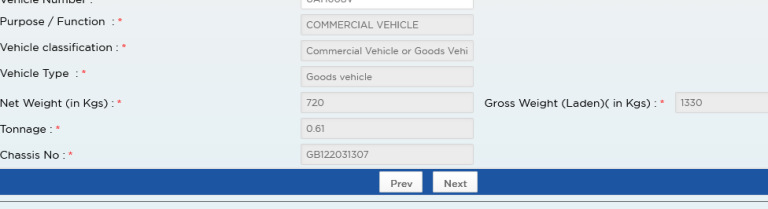

Depending on where you decide to go for your vehicle financing, you need to understand that a certain fixed percentage of the loan amount payable monthly is always a must to be paid. Also, it is important for you to read well the terms and conditions before you sign the car loan application. Carefully picking the right car gives you the freedom not to regret if anything happens.

You can use the car as an Uber driver, or even join other taxi hire companies and see money coming in from time to time. This is the very money you can use to repay the loan timely and without worrying about any fallbacks. Once you are done, you are ready to capture the perfect moment similar to how the Zintego Photography Invoice Template does the magic when it comes to creating and managing business invoices.

The next time you want to drive your dream motor vehicle but have no money, you might consider going for a car loan without security as it is simple and friendly for as long as you have where to get the funds to pay for the loan in Uganda.

Discover more from Thekonsulthub.com

Subscribe to get the latest posts sent to your email.