We all know that mistakes are human right. And so, this guide is all about how you can be able to claim your Uganda Revenue Authority payment made in an error for example having generated and paid a PRN in the wrong names, not having got the service you paid for, having paid twice for the same service and any other reason which may have called for you wanting to get a full refund from URA.

Faridah asked someone to generate for her a URA Payment Registration slip for her drivers permit renewal. The person used Sharifah instead of Faridah which meant that he used the wrong names. This mistake was only found after the permit renewal fees had been paid in the bank and after three full days.

When Faridah went to Kyambogo Face technologies to have the permit renewed, she was told how the two names were different and that she couldn’t be helped out. She went to the bank which processed the payment and they also let her know how it was unable to cancel the payment since it was over due. She was then referred to URA for a refund, a process she started on, and which is the very one I am sharing with you below.

Many people do make payment mistakes unknowingly and many don’t even know that URA has a way to pay them back for as long as they file they Refund using the right for. Below are the procedures one should follow in order to get a payment refund from Uganda Revenue Authority.

Procedures to get tax refund online and offline

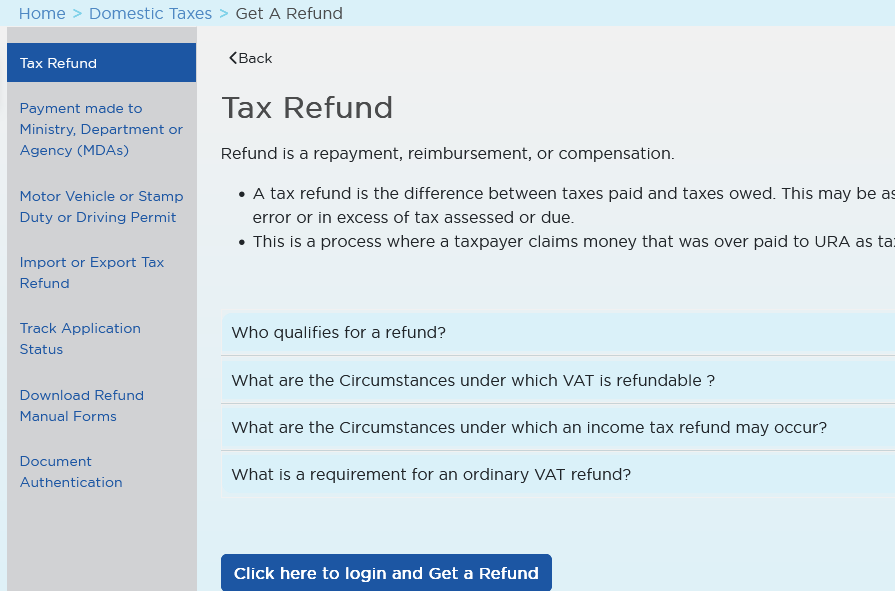

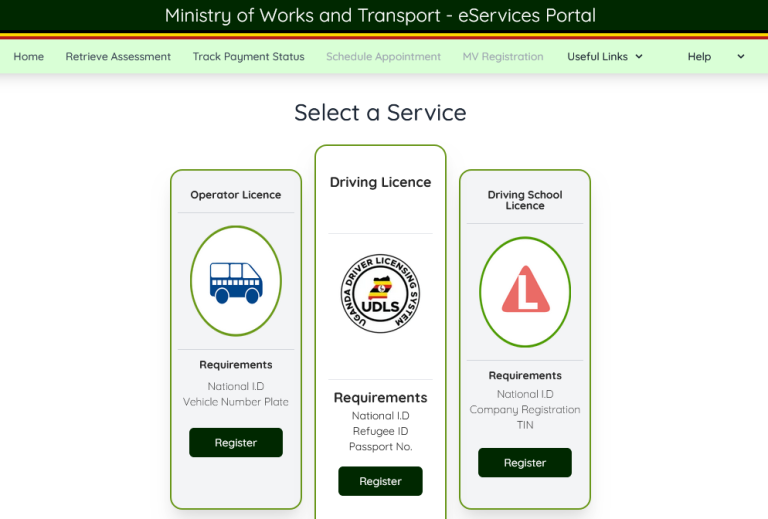

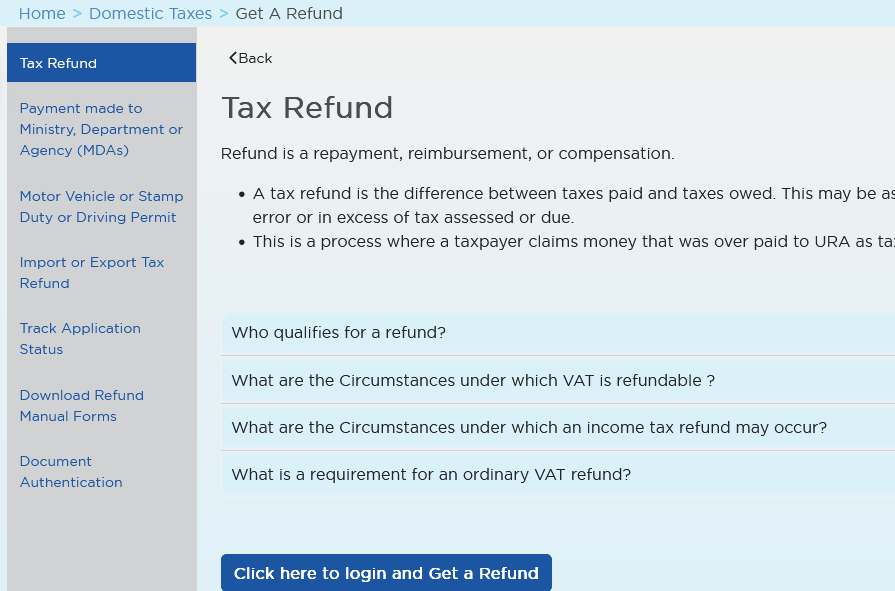

- Visit URA web portal online.

- Type “Payment refund” in the search box

- Select the type of refund you are applying for.

- Enter your login details for refunds that require login

- Submit your the tax refund form and wait for approval.

Alternatively, select download Manual forms, Select refund forms and download DT-3008 – Tax Refunds Claim Form.

Fill all of the required fields including Section A which requires your taxpayer information like Names, physical address and others. Section B which is the refund claim details including the type of refund for example Income tax, GPBT, Stamp duty, Motor vehicle, Driving permit, Provisional tax, final income tax, PAYE, Withholding tax, Assessment order, amount, total refund required, amount in words and others.

Fill section C which requires you to provide the reasons and or circumstances leading to the claim, section D which requires your bank details (account number and bank name plus branch for which the payment will be made). Please note that the account number must be in the names of the tax payer – one who is making the claim or otherwise, you claim might not be paid.

Fill in section E which requires the Original proof and attachments of the payment you made wrongly. You should also fill in the Declaration which is section F and making sure that you sign the form.

After, you should head to URA Nakawa, or any other branch and submit your form for refund. The process takes up to 3 full months or 90 days to be cleared. You should attach your ID and any other attachments required.

Discover more from Thekonsulthub.com

Subscribe to get the latest posts sent to your email.