Here is how to get an Instant URA TIN number in Uganda. By following these simple instructions, you will have your new TIN within seconds.

Applying and getting the URA instant TIN begins online on the Uganda revenue authority web portal, and you need an internet-enabled device like a smartphone, tablet, or computer in order to get started.

The process involves filling the online form with the required information including a NIN number or a driver’s license number, or a passport number (identification type”, phone number, and email address.

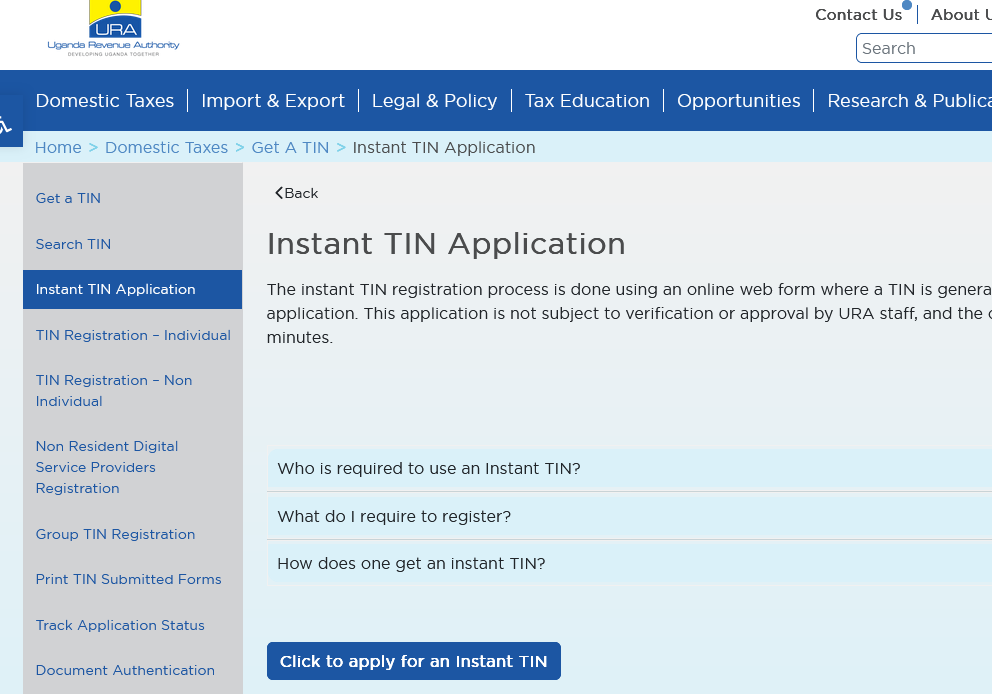

Get An Instant URA TIN

- Visit “ura.go.ug“

- Click on “Domestic Taxes”

- Click on “Get a TIN”

- Click on “Instant TIN application”

- Clink on “Apply for Instant TIN”

- Wait for the “New browser tab” to load

- Select “Identification Type” from the dropdown

- Fill in the “Identification Number”

- Select “Date of Birth” using the popup

- Select “Income Source Details”

- Fill in “Phone Number and email address”

- Select your “District, etc”

- Confirm you are not a “Robot”

- Click “Submit application”

Kindly wait for the form to be submitted. Upon successful verification of your submitted information, your instant TIN will be issued and displayed on the screen with the option to download the PDF attachment. You will also receive an SMS text message notification on your phone number and so on the email address with your newly issued TIN number.

But before signing off, take time and learn more about the URA TIN.

What is a TIN Number in Uganda?

A tax identification number is a unique 10-digit number that is issued by the Uganda revenue authority to individuals (persons) and non-individuals (Companies, organizations, etc) and is mandatory in order to access certain services as outlined by the law.

Uses of a TIN Number

You need a TIN Number if you want to at any time want to access any of the following services. These at the same time serve as the importance and uses of the tax identification number in Uganda.

- Import and export of goods

- Claim payment refunds and other tax benefits

- 50+ Million shillings bank loans

- Bid for supply and purchases of goods/services

- Obtain a KCCA trading license

- Obtain company bank account

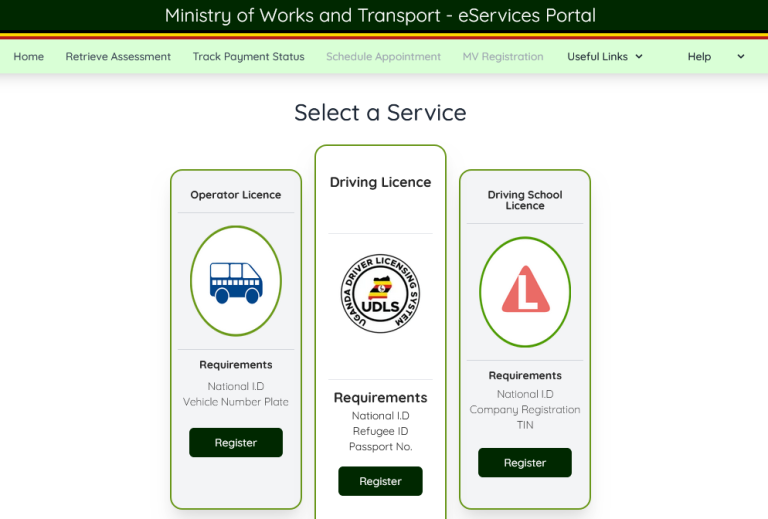

- Register and transfer of motor vehicles

- 50+ Million Shillings land processing, etc

Also check: How to get internship placements in Uganda?

Requirements for individual tin number registration (Excel Option)

Individuals must provide the below requirements which without, it becomes difficult to have the TIN registration application approved. Those requirements include;

- Duly filled and signed DT-1001 form

- Two copies of different IDs.

- Working email and phone number

- Proof of employment (income source)

- Referee with a Tax number

Requirements for non-individual TIN registration

Non -Individuals (Limited companies, partnerships, diplomatic missions, government institutions, funded projects, local authorities, NGOs, CBOs, etc) must provide the below requirements to have the TIN registration application processed and approved.. Refer here for additional info.

- Duly filled and signed DT-1002 form

- Copy of registration certificate (certificate of incorporation or business registration)

- Copy of the Company Form 20

- Copy of statement of particulars

- Working email and phone number

How to register for a tax identification number?

Whether you are an individual or non-individual, follow the below step-by-step procedures to register for a TIN number.

- Visit URA web portal

- Scroll down and click “download online forms”

- Click (DT-1001 for Individual or DT-1002 for Non-individual registration)

- Save the form and open it on your computer

- Enable Macros in MS Excel and fill out the form.

- Click Validate at the End of the form and Save the upload file.

- Open the web portal again and go to “eServices”.

- Click “Individual Registration” and select “New form”.

- Enter your name, select the file, agree on terms and click upload.

Print uploaded forms, attach all copies of the requirements and submit them to any Uganda revenue authority branch office (Nateete, Ham shopping grounds, Nakawa, DTB Kampala road, Nansana, Makindye, Katwe, etc). Your documents will be verified and you will be issued your unique number right away.

Note: An active internet connection on a computer is a must. Your computer should also have the Microsoft Excel feature installed since it is the program that is required to fill the downloaded forms. A printer attached to your computer is necessary to help you print out the hard copies you are supposed to hand submit to URA.

How to correct, change, or update (amend) tin number details?

You can correct, change or update your URA TIN number details and information online or offline depending on the reason why you are amending. You can change your names (with supporting documents), address (email, phone number, etc), identification, business and etc.

Performing an online amendment requires login access to your online TIN account while an offline amendment doesn’t require online access but the TIN owner’s presence.

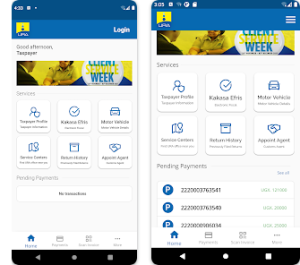

Online TIN number amendment

- Log into your URA account

- Scroll to “eServices”

- Hoover under “E-Registration” and click Individual Registration

- Fill in all details you want to change

- Click Submit.

Offline TIN number amendment

- Visit URA web portal.

- Scroll and click “download manual forms”

- Click “Domestic taxes”

- Click “Registration forms”

- Click “DT-1003 – TIN Individual Amendment Form” or

- Click “DT-1004 – TIN Non-Individual Amendment Form”

- Download, save and print the form.

- Fill it in indicating your updates/corrections and the effective date of the change.

- Attach your ID (individual) and submit it to any nearest URA branch office.

Note: Whether you do it online or office, after your application for amendment has been acknowledged, you will receive an acknowledgment number that you can use to track your application.

Winding up

A TIN number is a wide topic. Since the same can be used to serve more than one task, all of those who want to fulfill their tax obligations must acquire, get or register for one as its the only way you can use to access particular services as outlined above.

If you have any questions or suggestions, feel free to post a comment below using the form. I will be very happy to respond to you.

Discover more from Thekonsulthub.com

Subscribe to get the latest posts sent to your email.