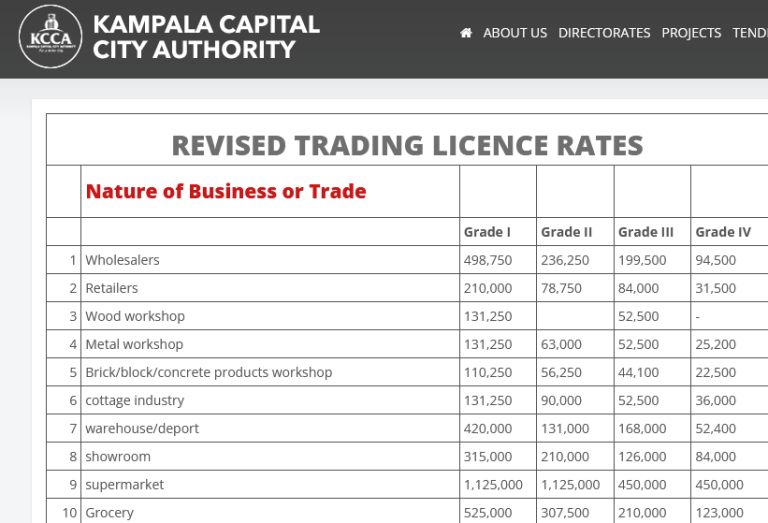

Have you been locked out by KCCA agents due to an expired trading license? Are you a new business operator looking out on how to instantly clear your Kampala city tax obligations? Or your shop, lockup, premises, garage and another other has been locked up and a Seal added on your door? No matter what your problem may be, taking time and going through this article may help you out.

Trading license renewals are given to persons / businesses or even companies who had previously paid for the same in the past / last financial year for example 2015/2016, while new licenses are given to new business entrants and or to those who have been operating illegally after they make up their minds to operate legally by clearing their tax obligations.

In this tutorial, I am covering all about “how to instantly renew your Kampala capital city authority trading license” other than applying for a new one. But briefly, I will extract some details about the procedures for acquiring a new license, in addition to applying and getting your KCCA eCitie Coin.

Procedures and requirements for getting a New KCCA Trading License

- Apply and get a URA Tin number, your unique tax number.

- Register your Company or Business with URSB.

- Create a KCCA eCitie Coin, a unique identification number.

- Visit KCCA office for Approval and assessment.

- Take payment receipts and be issued a license

The above step is mandatory if you are new and don’t have a past Trading license already. And you need all of the above in order to be issued with one. But if you already have one, then follow the procedures below to have it renewed.

Procedures and requirements for getting a New KCCA Trading License

- Pick your past year / previous year KCCA trading license eg 2014/15 financial year.

- Visit any nearest KCCA offices eg Rubaga, Central, DTB Opp Entebbe road, Makindye, City Hall and etc.

- Hand in the old license for an assessment to be issued, and pay in the bank as recommended.

- Take back the payment receipts to the same table you were issued an assessment from.

- Wait and you will be issued with your Trading license.

Please note that you are too required to Pay URA income tax fees, and which will too be given their own assessment and have it cleared in the bank. Just in case you don’t know where to begin from, feel free to Call for my help on 0752009001 and I will be happy to guide / assist you where necessary.

Discover more from Thekonsulthub.com

Subscribe to get the latest posts sent to your email.