The process of applying for, and getting Uber car loans in Uganda is very simple and easy once you follow the set Vehicle financing procedures as outlined by the giver. Whether you want to drive with Uber but your car doesn’t meet their requirements or have no money to buy a car to use, this article has got you covered.

How to make it with Uber

Driving with Uber is one of the most lucrative business opportunities available in Uganda where different people regardless of their age, gender, financial status, etc are making it in life for simply driving. Yes, no need for searching and looking out for Jobs when you can be your own boss, and work at your convenience.

As a Uber driver, the money you bring in depends on how committed you are, when, where, and how often you drive. This means that the more trips you take up, the higher your chances of earning thereby increasing your wealth.

How to Join Uber as a Driver

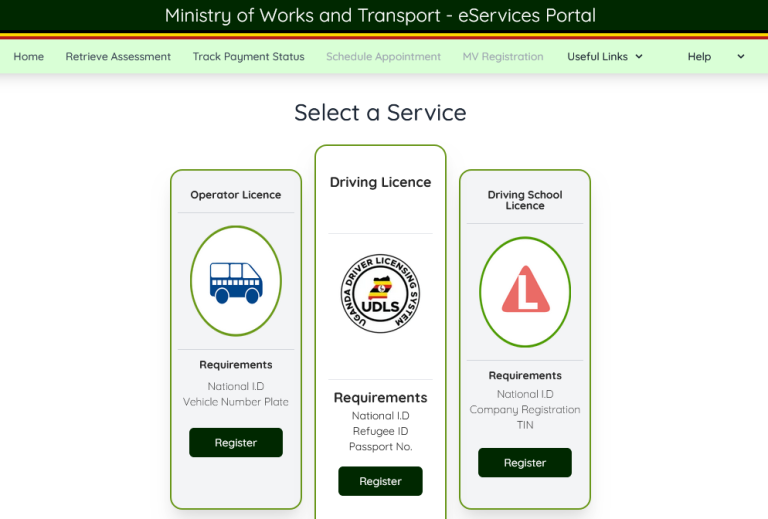

In order to join Ubewr as a Driver, you will need to sign up for an account. Make sure that you have the minimum requirements for drivers which includes a valid driving license, certificate of Good Conduct from Interpol, being aged 21+ years of age, providing a driver profile photo, and having completed a short virtual information session.

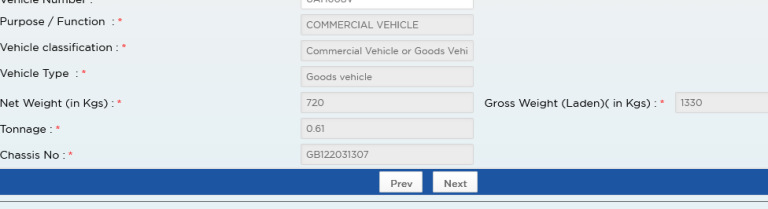

If you already have a vehicle, make sure it fits the requirements including being in excellent working condition, having a working radio, air conditioning, and at least four doors. Additionally, you will need to have the KCCA Permit, Vehicle third-party insurance, and TLB Sticker before you start to drive. Here is a list of Uber-accepted vehicles.

How to get Uber car loans in Uganda

Uber has a vehicle financing program for people who want to drive in Kampala Uganda. This program is designed for drivers who want to apply and get cars of their own at a lost cost with up to 36 months repayment period.

Uber has partnered with Yako Microfinance, a financial institution in Uganda where you can obtain your Uber car loan upon payment of 25% value of the vehicle.

About Yako Uber car loan

- Vehicle type: Toyota Raum, Spacio, IST, Wish, Vitz & Premio

- Weekly price: between Ugx.200- 250K

- Mileage: unlimited kilometers

- Duration: max. 36 months

- Insurance coverage: comprehensive vehicle insurance included

- Deposit: 25% value downpayment- bank offering 75%

- Admin fees: 2% arrangement fees

- Ownership option: ownership available after the loan terms

Application requirements

- Driver ratings higher than 4.3

- Average driving hours is 40 over the last 6 weeks

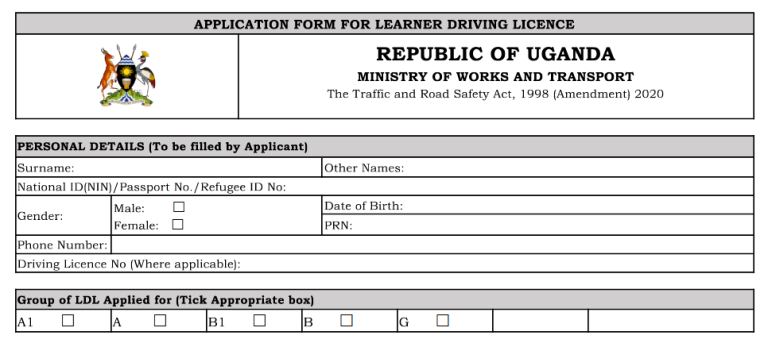

- Driver must hold a Ugandan national ID card, class B driver’s permit

Instructions to get a Uber car loan in Uganda

Visit the Uber office and submit your deal application. Within a few days, you will receive the outcome aka feedback on your application. You will be required to pay the initial 25% of your car value and wait for your vehicle given to you and hit the road.

Final Thoughts

The next time you are looking to b become a Uber driver but have no vehicle, not even have collateral or security, look no further. Make use of the Uber vehicle financing program and join the people who work on their own. The entire process is very simple and easy with the option to return the car in case things go wrong.

Discover more from Thekonsulthub.com

Subscribe to get the latest posts sent to your email.