Here is a list of the best 10 boda boda banja loan companies in Uganda for 2025. If you have made up your mind and decided to boost your family income by getting a boda loan fast, you might want to do it through the best and most trustworthy companies that will support your cause, and help you achieve your goal as opposed to taking your back-ward.

With so many boda-boda loaning companies available, not all of them are willing to support your success. Many are simply there to make you fail thus reaching their target of earning more by using you. By reading this article, you will find the best company you might consider trying in order to secure a boda loan that will benefit you.

Disclaimer: This article is for informational purposes only. Thekonsulthub.com is not affiliated with any of the companies listed and therefore, we advise you to consider other factors, and check the company terms and conditions well before you eventually make a decision. For more about this, read our disclaimers page.

10 Best Boda Boda Loan Companies in Uganda

- Tugende boda

- Opportunity bank boda loan

- Mamidecot Uganda boda loan

- SafeBoda Loan

- Boda Boda Banja Ltd

- Asaak Boda Boda Loan

- Wazalendo boda-asset loan

#1. Tugende boda

I never knew about the Tugenda boda service not until, Mugumya, a friend of mine who is a safeboda rider narrated it to me. Tugende is a boda leasing service that helps full-time motorcycle drivers get access to their own bikes.

Tugende Motorcycle Loan Requirements

- Being at least a one experienced rider

- Belonging to a certain stage for at least 6 months

- Attending daily classes

- Provide 2 guarantors who can be your family or friend

The above gives you access to become your own boss courtesy of tugende. Visit any of the Tugende branch offices or https://www.gotugende.com/ to get started.

#2. Opportunity bank boda loan

If you have a dream of expanding your business, opportunity bank has a plan for you. Through their boda-loan which is aimed at helping motorcycle riders to succeed and enlarge their business, you are on track. All you need is to visit any of their branches and make an inquiry.

Requirements:

- An initial deposit of 500,000/ ugx

- An active bank account with them.

- A motorcycle riders license

- Be a member of a stage, etc.

Visit any of their opportunity bank branches and make inquiries. Also, check all requirements on https://www.opportunitybank.co.ug/loans/boda-boda-loans/

#3. Mamidecot Uganda boda loan

If you are a youth and really want to become self-employed, a Mamidecot boda loan is suitable for you. With a mission meant to improve mobility, transport of goods to the market, etc, you are a few days to join the rider owners from the employees level.

Mamidecot Uganda Loan Requirements:

- Open up an account with them.

- Get a Banja loan when its the time.

Visit Mamidecot office located at Masaka-Kampala road adjacent Nyendo-Total fuel station and make an inquiry. Also, check all requirements on http://mamidcotug.com/loans

#4. SafeBoda Loan

SafeBoda is another service provider which gives riders boda-boda loans. Also known for offering a safe riding experience with well-trained riders, you can never go wrong with them as your choice.

SafeBoda Motorcycle Loan Requirements:

- You must be their safe-rider

Visit the SafeBoda office for more on this. Also, check all requirements on https://safeboda.com/ug/

#5. Boda Boda Banja Ltd

I know many of you know about this scheme. The scheme is available in Kampala with an aim of helping riders become self-employed and enjoy the benefits associated.

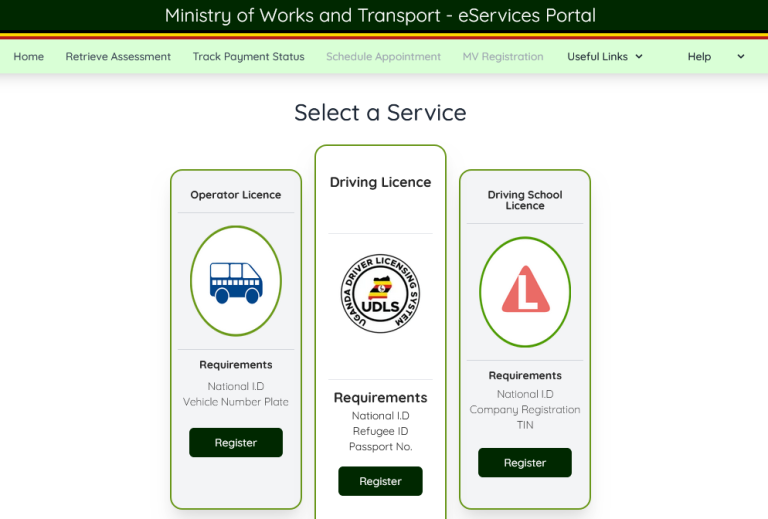

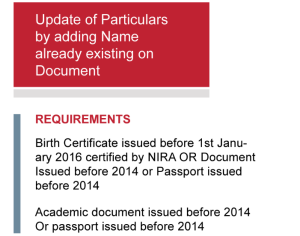

Boda Boda Banja Requirements

- Valid applicant Identity card

- Valid ID for the 2 guarantors

- LC1 introduction letter better

- Motorcycle Riders license

- Passport photos for the applicant and his guarantors

#6. Asaak Boda Boda Loan

Asaak lets you pay an initial deposit, sign-up for a flexible payment plan, and fully own your own boda in 12, 24, or 30 months. It’s fast, easy, and affordable.

Asaaka Boda requirements

- Applicant valid National ID.

- Initial deposit of UGX. 795,000.

- 2 guarantors with valid National IDs

- Visit their office for verification

You can apply for the Asaaka boda loan by visiting any of their offices and filling out their application form, or by downloading their app from the Google Play store and following the prompts as shown here.

#7. Wazalendo boda-asset loan

The Wazalendo boda-asset loan is designed for members who want to start a boda business to supplement their income by getting motorcycles supplied by Simba Auto Motives at a reduced cost.

Wazalendo boda requirements

Visit this page for details.

- Mogo loan – At an initial payment of 700,000/+, you are ready to join the lucrative business and boost your income courtesy of mogo.

- Deed microfinance – Deed microfinance will give you the boda loan if you want to supplement your income, or even use the motorcycle for any other purpose.

Deed motorcycle loan requirements

- Source of Income

- 2 guarantors

- Valiad applicant National I.D, Passport, or Driving Permit

With a high number of companies offering boda-boda loans in Uganda, securing a motorcycle loan has continued to become easy with affordable terms. Right from banks to individual lenders, you are able to secure yourself a motorcycle loan, something which can help you make easy money in this transportation sector. With customers available, there is no loss since at least, you are able to make good money to pay off your loan, and also to help you continue living.

If you want to secure a boda boda loan in Uganda, you can try out some of the above providers.

As you can see above, each has its own set of requirements, terms, and qualifications. Others will require you to pay half of the agreed boda boda cost, others will require partial payment of at least 1,000,000/=, while others may require you to have been working with them, for example, safe boda.

In reality, where and how to get a boda loan in Uganda largely depends on a number of factors as determined by the loaning provider. For example, you must be a rider with safeboda in order to get a loan from them, you must have or be willing to obtain a driving permit as a pre-requirement in Tugende, etc. From a bank, you must at least have an account with them and at least have been saving something, etc.

Discover more from Thekonsulthub.com

Subscribe to get the latest posts sent to your email.