Using a URA motor vehicle tax calculator is vital when it comes to helping one make an estimate of the exact amount of taxes they are liable to pay. Whether you are planning to import a used or brand new motor car, using either of the 3 motor vehicle tax calculators will help you get a figure on what URA will likely charge you.

It should be noted that the Uganda Revenue Authority has a set of guidelines that must be taken into account when making a tax calculator. Most URA motor vehicle tax calculators on the internet take into account those guidelines in order to help you make an estimate of the amount you will likely pay.

Also read: How To Get A Postal Address In Uganda

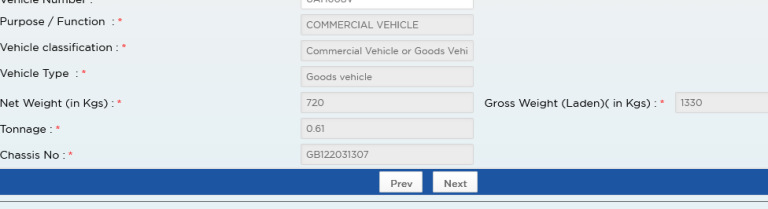

Before using any of the available URA tax calculators, make sure that you have some of the information below;

- The motor vehicle make and model

- Year of manufacture

- CIF (Cost, Insurance, and Freight) amount

- Purpose e.g Luxury

The 3 URA tax calculators you can try

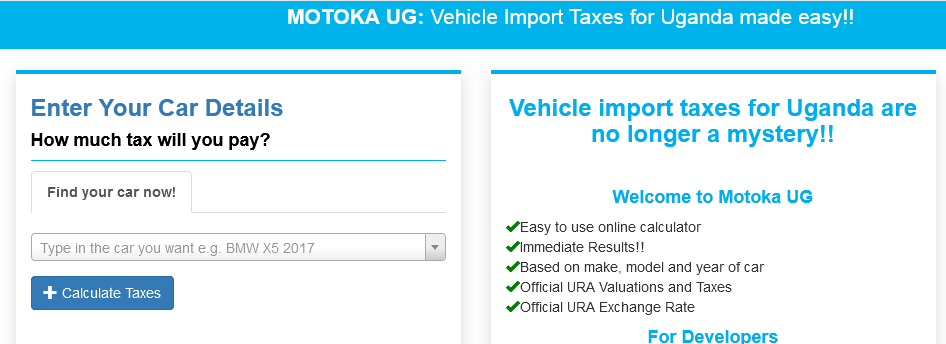

1. Motoka.UG URA tax calculator

How to use this tool

- Visit Motoka website

- Click quick or advanced

- Enter all required details

- You will be shown the estimated amount

2. Carused.jp URA tax calculator

How to use this tool

- Visit Carused website

- Click “Use the calculator”

- Enter all required details

- You will be shown the estimated amount

3. Calculator.co.ug URA Vehicle Import Duty Calculator

How to use this tool

- Visit Calculator.co.ug website

- Start by selecting car make and model

- Enter all required details

- Click “Calculate”

- You will be shown the estimated amount

Things to note: All of the 3 URA motor vehicle tax calculators above return estimated results more than actual results. You should use them for informational purposes only and in no way you should take the estimated tax costs and fees as official.

You should always consult a professional clearing agent or URA help for a proper assessment of the actual fees you are supposed to pay for your imported motor vehicle.

Discover more from Thekonsulthub.com

Subscribe to get the latest posts sent to your email.